Backlash comes as supervisors explore tax proposals

A growing list of tax ideas, from sales taxes to a major real estate transfer fee, has sparked strong opposition as the county confronts major budget deficits and funding gaps amid higher spending

COUNTY — A sweeping package of new tax proposals is taking shape at the San Diego County Board of Supervisors, triggering fierce pushback from Supervisor Jim Desmond, other elected officials, and several business owners.

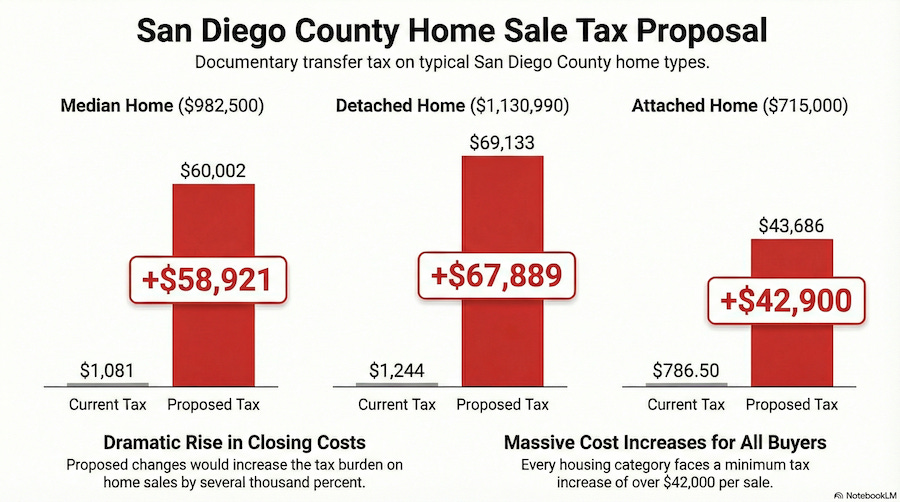

The ideas on the table include a major documentary transfer tax on real estate sales, a one-time transfer fee on the top 1% of real estate transactions, a half-cent sales tax, and a possible local payroll tax to close budget deficits amassed by the county and offset federal funding cuts.

Desmond’s coalition held a press conference Tuesday at the San Diego County Administrative Building, ripping the proposals as unaffordable in a region already grappling with some of the nation’s highest housing, utility and living costs. Desmond raised during Wednesday’s meeting opposing the tax, but the board delayed the discussion until February’s meeting.

San Diego is the 10th most expensive city in the world, Desmond noted, adding voters rejected a series of tax increases in 2024. He said residents are already being squeezed by the high living costs despite the county’s record revenues and an $8.6 billion budget.

“San Diego County residents are getting hit from every direction,” Desmond said. “We have a 40% growth in the number of people that actually work here at the county. To me, a lot of those departments were duplicative or handled by the state, and we really didn’t have to do it.

Over the past six years, the county has added more than 10 new departments, hired 2,500 employees, and used one-time funding for ongoing expenses, Desmond added. He said the short-term plan is to spend and raid the reserves, with the long-term goal of raising taxes.

The supervisors recently approved $25 million in bonuses for employees ($1,000 per employee) in a contentious 3-2 vote last year. The bonus structure was set at $1,000 in 2025, $500 in 2026, and $250 in 2027, but was contingent on the board changing the reserve policy, which it was able to do with Supervisors Terra Lawson-Remer, Paloma Aguirre and Monica Montgomery Steppe in support.

However, they were not able to use reserve funds for the bonuses, as it required four yes votes. So, the bonuses came from county department budgets, according to reports.

“In the past five years, county government has grown over 40%,” Desmond explained. “San Diego County didn’t grow 40% in population. Families didn’t get 40% raises and small businesses didn’t see 40% in growth, but yet, our government … did.”

The county had to cover a $138.5 million budget deficit for Fiscal Year 2025-26. The deficit is projected to top $321.8 million by 2030, according to reports.

The tax proposals

The sales tax is being proposed by a coalition of labor unions and nonprofits (SEIU Local 221, Cal Fire Local 2881 and Children First San Diego) for a 0.5% increase. The revenue would be allocated to health and safety facility improvements, homelessness services, wildfire prevention and disaster resilience, mental health and addiction treatment, and oversight and administrative transparency.